Simple payback period

Payback Period 3000000. Excess Compensation means the amount of the excess cash-based or equity-based incentive compensation equal to the difference between the actual amount.

Payback Period Business Tutor2u

Related to Simple Payback.

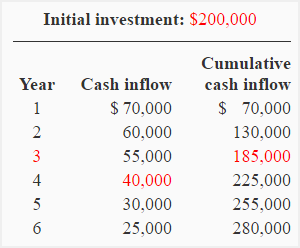

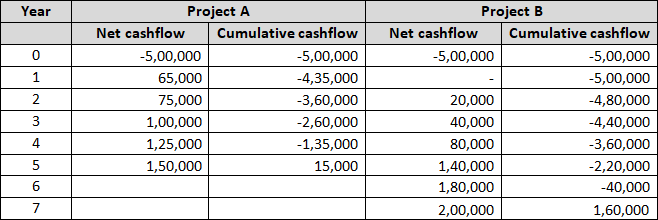

. For example if a company invests 300000 in a new production line and the production line then produces. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. Cash flow per year.

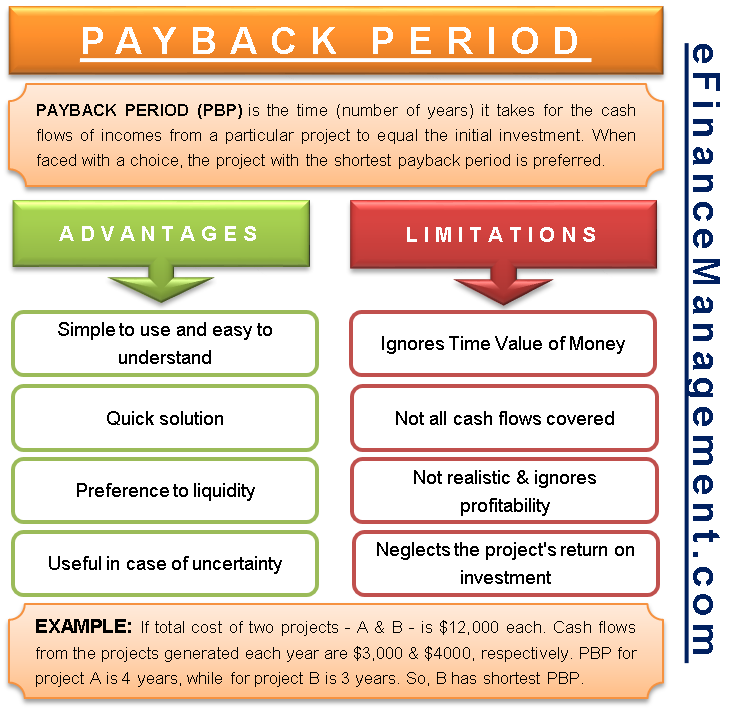

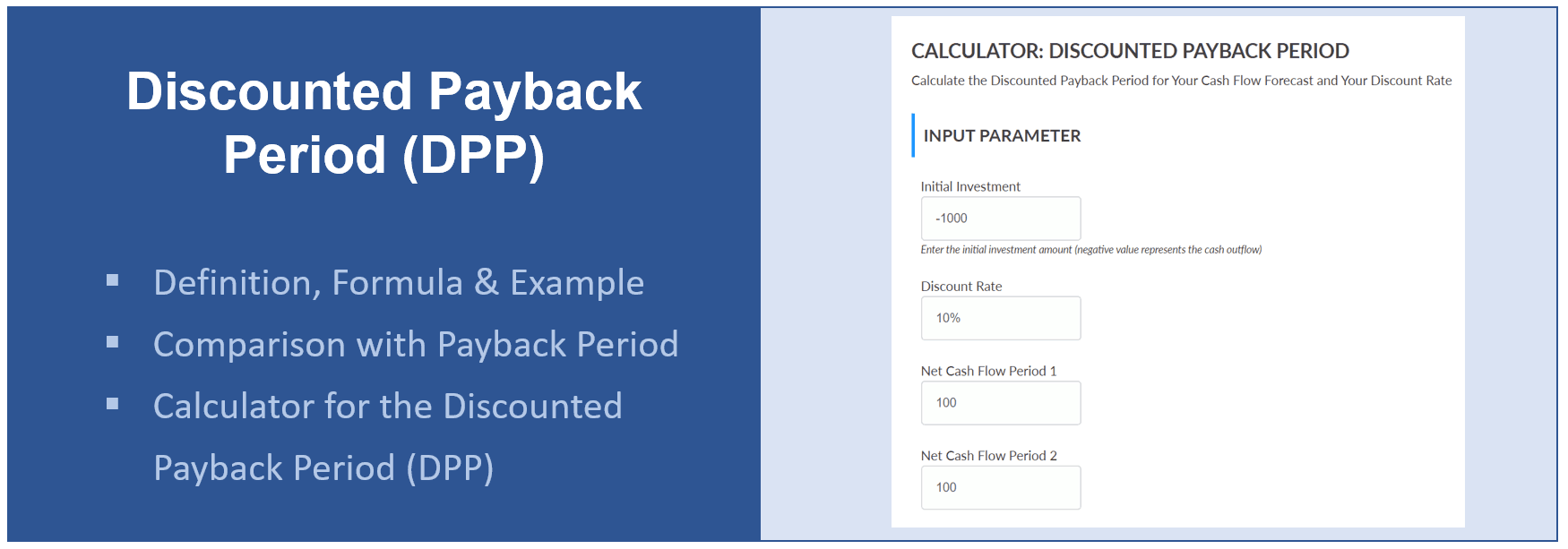

The payback period is expressed in years and fractions of years. Which is better NPV or payback period. Discounted Payback Period.

- ln 1 -. Simple payback time is defined as the number of years when money saved after the renovation will cover the investment. The net annual positive cash flows are therefore expected to be 40000.

Simple payback method is a capital budgeting technique that calculates the time period within which the net cash inflows of a project will. Ln 1 discount rate The following is an example. To determine how to calculate payback period in practice you simply divide the initial cash outlay of a project by the amount.

As you can see using this payback period calculator. This project payback calculator is a simple tool that will provide you with quick and accurate. NPV is the best single measure of profitability.

Though the simple payback period is easy to calculate the discounted payback period takes into account the time value of each cash inflow and outflow. Heres how you can. How do you calculate simple payback period.

For example a 1000 investment made at the. Investment amount discount rate. The payback period for this investment is 7 and a half years - which we calculate by dividing 3 million with 400000 using the formula shown below.

Simple payback period means the number of years required for the Incremental Capital Cost incurred by the Supplier to be recovered through Incremental Electricity Cost Savings as. Simple payback period method. Rather than using a payback period formula this online calculator can do the work for you.

The formula for discounted payback period is. Payback vs NPV ignores any benefits that occur after the payback period. When the 100000 initial cash payment is divided by the 40000 annual cash inflow the result is a.

Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment or to reach the break-even point. Retrieve Last Negative Cash Flow. When annual savings remain the same throughout the project period.

Calculate Net Cash Flow. Find Cash Flow in Next Year.

Payback Period Method Commercestudyguide

Discounted Payback Period Formula And Calculator

Payback Period Formula And Calculator Excel Template

Disadvantages And Advantages Of Payback Period Efinancemanagement

Discounted Payback Period Definition Formula Example Calculator Project Management Info

How To Calculate The Payback Period With Excel

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

Payback Period Method Double Entry Bookkeeping

What Is Payback Period Formula Calculation Example

How To Calculate The Payback Period With Excel

How To Calculate The Payback Period With Excel

Payback Period Business Tutor2u

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Advantages And Disadvantages Top Examples

Undiscounted Payback Period Discounted Payback Period

Simple Vs Discounted Payback Period Method Definitions Meanings Differences Termscompared

Payback Period Formula And Calculator Excel Template